In a bold move that signals growing corporate confidence in digital assets, SharpLink Gaming Ltd. has announced a massive $667 million Ethereum (ETH) purchase, positioning itself among the largest corporate holders of ETH in the world. The acquisition reflects not only the company’s long-term faith in Ethereum’s blockchain ecosystem but also highlights the accelerating trend of corporations diversifying their balance sheets with cryptocurrencies. This strategic treasury expansion comes at a time when institutional interest in Ethereum is surging, particularly in anticipation of the network’s increasing role in decentralized finance (DeFi), tokenization, and smart contract innovation.

A Strategic Ethereum Treasury Play

SharpLink’s decision to allocate such a significant portion of its reserves to Ethereum marks a pivotal step in aligning with blockchain adoption trends. Ethereum has emerged as the foundation of the DeFi and Web3 economy, with thousands of decentralized applications (dApps), NFT platforms, and enterprise blockchain pilots running on its network. By committing $667 million into ETH, SharpLink is effectively betting on Ethereum’s growth trajectory as both a financial and technological backbone of the future internet.

Company executives stated that the decision reflects a “forward-looking capital allocation strategy” aimed at maximizing shareholder value while hedging against fiat currency volatility. Much like MicroStrategy’s Bitcoin-centric treasury strategy, SharpLink’s pivot into Ethereum signals growing confidence in ETH as a store of value and innovation driver.

Ethereum’s Growing Institutional Appeal

Ethereum has steadily evolved from being viewed as a speculative digital asset to an institutional-grade investment. With the rollout of Ethereum ETFs in the U.S., increasing regulatory clarity, and growing recognition of ETH as a “commodity-like” digital asset, major investors are more comfortable than ever in allocating capital to it.

The Proof-of-Stake (PoS) model, introduced after the Merge in 2022, has also enhanced Ethereum’s appeal by reducing energy consumption and allowing ETH holders to earn staking rewards. SharpLink’s treasury could generate substantial passive income through staking while also gaining exposure to potential capital appreciation.

Industry analysts suggest that SharpLink’s investment may inspire other mid-to-large corporations to follow suit, further strengthening Ethereum’s position as the second-largest cryptocurrency by market cap and potentially narrowing the gap with Bitcoin in corporate adoption.

Market Impact: ETH Price Momentum

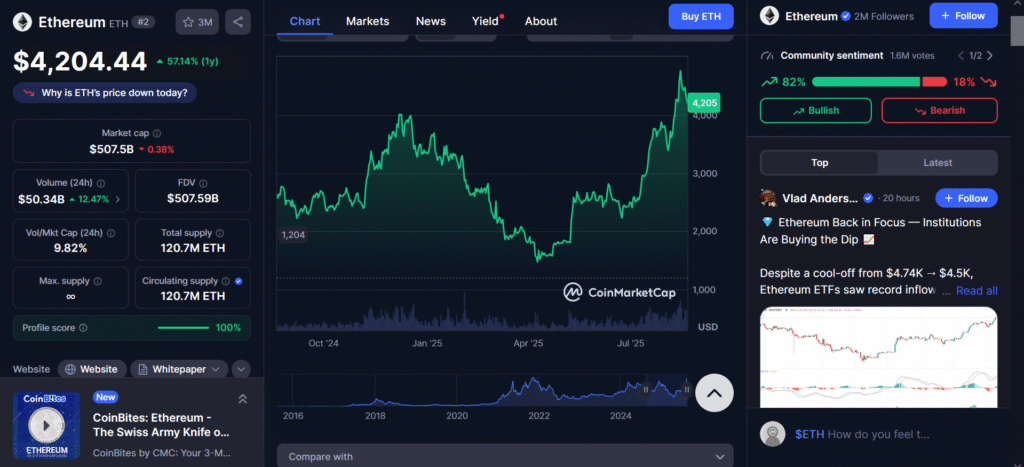

Following the announcement, Ethereum markets saw a notable uptick in trading volume, with ETH briefly testing new resistance levels around $4,200. Market watchers believe that SharpLink’s massive buy-in could create a psychological floor for Ethereum prices, instilling renewed investor confidence.

Technical analysts highlight support levels at $4,200 and resistance around $3,600, suggesting that ETH could enter a bullish breakout phase if institutional demand continues to rise. With large treasury buys like SharpLink’s, ETH’s circulating supply on exchanges is expected to shrink, potentially leading to supply shocks that push prices higher.

At the time of writing, Ethereum is sitting at $4,197.50.

Broader Implications for Corporate Treasury Strategies

The SharpLink purchase underscores a broader shift in corporate treasury management. Traditional strategies have relied heavily on bonds, equities, and cash holdings, but with rising inflation and fiat depreciation concerns, companies are turning to digital assets as an alternative reserve asset.

While most firms that venture into crypto have focused on Bitcoin, SharpLink’s Ethereum-first strategy sets a precedent that could open the door for more corporations to diversify across multiple digital assets. This move also signals confidence in Ethereum’s utility beyond being a hedge, highlighting its value as a productive asset in DeFi and staking ecosystems.

Regulatory Outlook and Risks

Despite growing enthusiasm, corporate adoption of Ethereum is not without challenges. Regulatory uncertainty remains a significant factor, particularly in the U.S., where agencies like the SEC and CFTC have yet to issue consistent guidelines on ETH classification. However, with increasing institutional support, including ETF approvals, the regulatory narrative around Ethereum is shifting toward legitimacy rather than restriction.

SharpLink acknowledged the regulatory risks but emphasized its belief that long-term clarity will strengthen Ethereum’s role in global finance. Industry experts suggest that such large-scale purchases could accelerate government efforts to create clear frameworks for crypto asset management and taxation.

Future Outlook: Ethereum as a Corporate Reserve

The SharpLink treasury expansion represents a milestone moment in Ethereum’s institutional journey. As Ethereum continues to dominate in areas such as DeFi, tokenized real-world assets, and enterprise blockchain solutions, more companies may see ETH not only as a speculative asset but as a strategic reserve for long-term growth.

If similar treasury moves emerge from other publicly traded companies, Ethereum could experience a surge in adoption comparable to Bitcoin’s corporate wave in 2020–2021. For now, SharpLink’s $667M purchase is both a bold statement and a catalyst that could reshape corporate approaches to blockchain-driven finance.

FAQ: SharpLink’s $667M Ethereum Treasury Expansion

Why did SharpLink buy $667 million worth of Ethereum?

SharpLink acquired Ethereum to diversify its treasury, hedge against fiat currency risks, and align with the growing adoption of blockchain technology and decentralized finance (DeFi).

How will this Ethereum purchase impact SharpLink’s business strategy?

The investment strengthens SharpLink’s balance sheet, allows for staking rewards, and positions the company as a leader in Web3 adoption among publicly traded firms.

Could SharpLink’s Ethereum buy influence ETH prices?

Yes, such a large-scale purchase reduces supply on exchanges and boosts investor confidence, potentially driving ETH prices higher and creating stronger support levels.

How does this compare to companies buying Bitcoin for their treasury?

While most corporations like MicroStrategy focus on Bitcoin, SharpLink’s move into Ethereum highlights ETH’s utility in smart contracts, staking, and tokenization, making it a different yet equally strategic play.

What risks does SharpLink face with this Ethereum investment?

Risks include regulatory uncertainty, ETH price volatility, and potential changes in staking or DeFi protocols. However, long-term adoption trends favor Ethereum’s growth.

Jennifer Mistry is a seasoned crypto journalist and SEO-focused writer with over five years of experience covering blockchain, crypto, DeFi, and emerging technologies. She specializes in delivering impactful breaking news, sharp market analyses, detailed reports, and precise price predictions — all with speed and accuracy. With a background in computer science and software engineering, Jennifer has a unique talent for transforming complex technical concepts into clear, engaging content. Her SEO-driven approach ensures articles are both highly optimized and reader-focused. At criptz.com, she leverages these strengths to keep audiences informed, empowered, and ahead of the curve.

Why Trust CRIPTZ?

At criptz.com, we bring you up-to-the-minute cryptocurrency news and expert analysis in 2025. Our seasoned team delivers accurate coverage of market trends, blockchain breakthroughs, and emerging innovations, backed by strict editorial standards. With 24/7 reporting on price movements, regulations, and tech advancements, we empower traders and investors to navigate the fast-paced crypto world with confidence. Count on Criptz.com for trustworthy insights into digital assets.